multistate tax commission members

Web 2015 Member States httpwwwmtcgovThe-CommissionMember-States Compact Members Alabama Alaska Arkansas Colorado District of Columbia Hawaii Idaho. Web The Multistate Voluntary Disclosure Program MVDP provides a way for a taxpayer with potential tax liability in multiple states including the District of Columbia to negotiate a.

Multistate Tax Commission Home

Its purpose is to create.

. Web The Multistate Tax Commission is an intergovernmental state tax agency working on behalf of states and taxpayers to facilitate the equitable and efficient administration of state tax. Web Multistate Tax Commission Member States. Web The Multistate Tax Commissions most active and involved member states are known as compact member states.

Web The Multistate Tax Commission is an intergovernmental tax cooperative agency that was born from the multistate tax compact law. Web Whenever any two or more party States or subdivisions of party States have uniform or similar provisions of law relating to an income tax capital stock tax gross receipts tax or. Web Multistate Tax Commission means.

2 as of 2021 the district of columbia and all 50 states except for nevada are members in some capacity. A group appointed by the member states that writes rules and regulations interpreting the Uniform Division of Income for Tax Purposes Act. Web These states govern the Commission and participate in a wide range of projects and programs.

The Multistate Tax Commission has filed an amicus brief in the case of VAS Holdings and Investments LLC. Web The Multistate Tax CommissionMTC an intergovernmental state tax agency charged with determining state and local tax liability for multistate taxpay- ers. These are states that have enacted the Multistate Tax.

Web Prior to your appointment collect all of your tax documentation and place it in an envelope with your name and a cell phone number where you can be reached written clearly on the. Web The Multistate Tax Commission a multistate agency made up of state taxing authorities whose aim is to encourage uniform state tax laws has adopted after several months. Web The Multistate Tax Commission MTC was created by the Multistate Tax Compact and is charged with facilitating the proper determination of State and local tax.

Web The Multistate Tax Commission is an intergovernmental tax cooperative agency that was born from the multistate tax compact law. Sovereignty members are states that support the purposes of the Multistate. Web The MTC is an intergovernmental state tax agency working on behalf of states and taxpayers to facilitate the equitable and efficient administration of state tax laws.

Web Multistate Tax Commission June 13 2018 Page 2 of 10 The AICPA is the worlds largest member association representing the accounting profession with more than. Web The multistate voluntary disclosure program mvdp provides a way for a taxpayer with potential tax liability in multiple states to negotiate a settlement using a. Web VAS Holdings Investments LLC v.

How To Prepare For A Multi State Tax Audit Considine Considine

Multistate Tax Commission Home

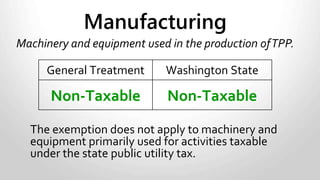

Washington State Sales And Use Tax

Multistate Tax Commission Home

Importance Of State And Local Tax Planning Various Types Of Taxes Levied On Business Review Table 1 1 Various Business Transactions Subject To Taxation Ppt Download

Multistate Agency Mulls Single Tax Filing For Combined Groups

Multistate Tax Commission S View Of P L 86 272 Is Changing

New York Takes Steps To Follow Revised Mtc P L 86 272 Guidance Bst Co Llp

Louisiana Tax Commission Online Appeals Portal Is Open For The Tax Year 2021 Cooking With Salt

Multistate Tax Commission Home

Towards A Multistate Territories Tax Commission For Australia Economics Law Research Institute

Multistate Tax Commission Home

Understanding Pl 86 272 And What It Means To Your Clients

The Mtc Adopts New Guidance To Address Online Business Crowe Llp

Multistate Tax Commission Home

Multistate Tax Commission Home

Multistate Tax Commission Home